Ein führendes deutsches Energieunternehmen plant, seine Aktivitäten im Bereich der erneuerbaren Energien strategisch auszubauen, insbesondere durch eine verstärkte Fokussierung auf Solarenergie. Im Rahmen dieser Überlegungen möchte die Geschäftsführung das Geschäftsmodell des global führenden Anbieters „Solify“ umfassend durchleuchten.

„Solify has significantly shaped the solar energy market in recent years through technological innovations and targeted international expansion. The company is experiencing steady growth, both in terms of the number of solar systems installed and its market share in various regions. Analysts forecast that Solify will increase its annual investment in research and development from €1.2 billion in 2021 to €2.1 billion in 2024. The aim of these investments is to further expand its technological leadership position, increase production efficiency and tap into new markets.

Graphic 1: Installation and maintenance costs

Marktdaten:

cost structure:

Additional challenges:

Erforderliche zusätzliche Investitionen

2.1 billion € - 1.2 billion € = 0.9 billion €

Average revenue per system

15.000 € + 3.000 € = 18.000 €

Installation costs + maintenance costs over 10 years = average income per system

Required number of additional systems

0.9 billion € / 18,000 € per system = 50,000 € per system

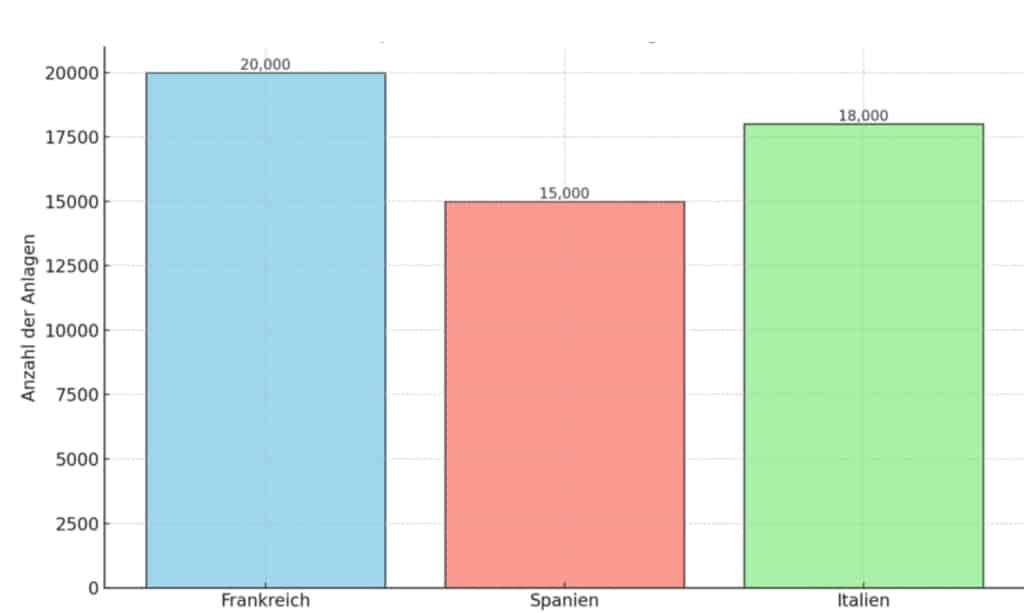

Grafik 2: Geplante zusätzliche Anlagen in neuen Märkten

Grafik 2: Geplante zusätzliche Anlagen in neuen Märkten

Gesamtauswirkungen der staatlichen Förderung

Assumed decline of 20 % with 6.3 million installed systems

6.3 million x € 1,200 x 20 % = € 1.512 billion

Additional income through international expansion

France: 20,00 plants x € 18,000 = € 360 million

Spain: 15,000 installations x € 18,000 = € 270 million

Italy: 18,000 installations x € 18,000 = € 324 million

Total additional revenue

€ 370 million + € 270 million + € 324 million = € 954 million

Hidden Champions provide various advantages compared to large consultancies such as McKinsey, BCG and Bain or the Big 4.

Exciting tasks, diverse career prospects and individual development opportunities.